Aeron Composite Limited IPO is going to be open to the public on August 28, 2024 and the closing date of the IPO is August 30, 2024. The company has aim to raise ₹56.10 from the public issue. The share allotment date of the Aeron Composite Limited IPO is September 2, 2024 and the listing date is September 4, 2024. Aeron Composite IPO is a fresh-issue and SME Book-Built Issue initial public offering (IPO), with a total fresh issue size of ₹56.10 crore for 44.88 lakh shares. The price band of the Aeron Composite Limited IPO is set at ₹121 to ₹125 per share and the lot size is 1,000 shares per lot.

You will find all the information regarding the company and its IPO on this page. This page will be updated regularly with the latest updates regarding the Aeron Composite Limited IPO.

Table of Contents

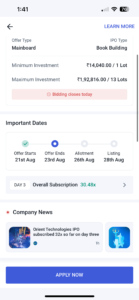

Aeron Composite IPO Details

| IPO Date | August 28, 2024, to August 30, 2024 |

| Listing Date | Wednesday, September 4, 2024 |

| Face Value | ₹10 per share |

| Price Band | ₹121 to ₹125 per share |

| Lot Size | 1000 Shares |

| Total Issue Size | ₹56.10 crore for 4,488,000 shares |

| Fresh Issue | ₹56.10 crore for 4,488,000 shares |

| Issue Type | Book-Built Issue IPO |

| Listing At | NSE SME |

| Overall Subscription | 41.07x |

| QIB Shares Offered | 50.00% of the offer |

| Retail Shares Offered | 35.00% of the Offer |

| NIIs Shares Offered | 15.00% of the Offer |

Aeron Composite IPO Important Date

The opening date of the Aeron Composite IPO is Wednesday, August 28, 2024 and the closing date is Friday, August 30, 2024. The basic allotment date of the IPO is Monday, September 2, 2024 and the listing date is Wednesday, September 4, 2024.

All the important dates regarding the Aeron Composite Limited IPO are mentioned below. Mark them on your calendar so you don’t miss any events.

| IPO Open Date | Wednesday, August 28, 2024 |

| IPO Close Date | Friday, August 30, 2024 |

| Basis of Allotment | Monday, September 2, 2024 |

| Initiation of Refunds | Tuesday, September 3, 2024 |

| Credit of Shares to Demat | Tuesday, September 3, 2024 |

| Listing Date | Wednesday, September 4, 2024 |

Aeron Composite IPO GMP Today

The IPO has now closed and has been oversubscribed by 41.07 times. According to the overall subscription rate the updated Grey Market Premium (GMP) for the Aeron Composite IPO is up to ₹36. The offering price for the Aeron Composite Limited IPO is between ₹121 to ₹125 per share.

The following table displays the trend of Aeron Composite IPO’s GMP over the past few days.

| GMP Date | IPO Price | GMP Price |

| September 3, 2024 | ₹121-₹125 | ₹36 |

| September 2, 2024 | ₹121-₹125 | ₹37 |

| September 1, 2024 | ₹121-₹125 | ₹38 |

| August 31, 2024 | ₹121-₹125 | ₹38 |

| August 30, 2024 | ₹121-₹125 | ₹32 |

| August 29, 2024 | ₹121-₹125 | ₹32 |

| August 28, 2024 | ₹121-₹125 | ₹54 |

| August 27, 2024 | ₹121 to ₹125 per share | ₹55 |

Aeron Composite IPO Lot Size

Aeron Composite Limited IPO offers a minimum of 1,000 shares per lot. Retail investors can apply for a minimum of 1 lot and a maximum of 1 lot, while high-net-worth individuals (HNIs) can apply for a minimum of 2 lots and a maximum of 4 lots.

The below table represents the future of minimum and maximum investment for retail investors and HNI concerning shares and amounts.

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 1000 | ₹1,25,000 |

| Retail (Max) | 1 | 1000 | ₹1,25,000 |

| HNI (Min) | 2 | 2,000 | ₹2,50,000 |

| HNI (Max) | 4 | 4,000 | ₹5,00,000 |

| Investor Category | Shares Offered |

|---|---|

| QIB Shares Offered | Not more than 50.00% of the Net offer |

| Retail Shares Offered | Not less than 35.00% of the Offer |

| NII (HNI) Shares Offered | Not less than 15.00% of the Offer |

| Share Holding Pre Issue | 100.00% |

| Share Holding Post Issue | 73.63% |

How to Apply Aeron Composite IPO?

Net Banking:

- Login to Internet Banking: Access your Internet banking account using your credentials.

- Browse to the IPO Section: Once logged in, go to the ‘Investments’ or ‘IPO’ section.

- Select the “Aeron Composite IPO”: Locate and select the Aeron Composite Limited IPO from the list of available IPOs.

- Fill out the IPO bid form: Enter the required details, such as your bid quantity, price, CDSL ID, and DP account information.

- Make Payment and Confirm Application: Complete the payment process as per the instructions and submit your application. If the IPO is not allotted to you, you will receive a full refund.

Angel One:

Here’s a step-by-step guide for applying to the Vdeal System IPO using the Angel One app:

- Install the Angel One app:

- Click here to Download the Angel One app from the App Store (for iOS) or Google Play Store (for Android).

- Install and open the app on your device.

- Create an Account: or Log In to Your Account:

- Open the Angelone app.

- Tap on “Sign Up” or “Create Account.” After creating your account, log in using your username and password.

- Navigate to the IPOs section:

- Once logged in, look for the “IPOs” option on the main dashboard or menu.

- Select Aeron Composite IPO and then click on “Apply Now.”

- Choose the lot size you want to apply for.

- Enter your UPI ID, where the payment for the IPO will be processed.

- Click on “Apply for IPO.”

- Review your application details and click on “Apply for IPO” for the last step confirmation.

By following these steps, you will have successfully applied for the Aeron Composite Limited IPO through the Angel One app

About Aeron Composite Limited

Aeron Composite Limited is an Ahmedabad-based manufacturer and exporter of glass fibre reinforced polymer (FRP) products. The company was established in 2011. They make and sell special plastic products called FRP, used in industries like oil, gas, and water treatment. Their products include FRP Pultruded Products, FRP Moulded Gratings, and FRP Rods. In 2024, the company earned ₹180.80 crore.

Aeron Composite Limited Financial Reports

Aeron Composite Limited’s total borrowing decreased by ₹1.91 crore (-13.65%) in FY2024 from FY2023, reflecting better debt management by the company. Despite a small revenue drop of ₹1.19 crore in FY24 from FY23. In FY2024 profit after tax (PAT) increased by ₹2.81 crore, a growth of over 42%.

| Metric | FY2024 (29 Feb 2024) | FY2023 (31 Mar 2023) | Change |

|---|---|---|---|

| Assets (₹ Crore) | 99.79 | 69.10 | +30.69 Crore (+44.40%) |

| Revenue (₹ Crore) | 180.80 | 181.99 | -1.19 Crore (-0.65%) |

| Profit After Tax (₹ Crore) | 9.42 | 6.61 | +2.81 Crore (+42.51%) |

| Total Borrowing (₹ Crore) | 12.08 | 13.99 | -1.91 Crore (-13.65%) |

Aeron Composite Limited KPIs

Here’s the table including the KPIs and their values for Aeron Composite Limited:

| KPI | Values |

|---|---|

| Total Borrowing (₹ Crore) | 12.08 |

| Revenue (₹ Crore) | 180.80 |

| Profit After Tax (₹ Crore) | 9.42 |

| Return on Equity (ROE) | 31.33% |

| Return on Capital Employed (ROCE) | 29.67% |

| Debt/Equity Ratio | 0.35 |

| Return on Net Worth (RoNW) | 27.09% |

| Price to Book Value (P/BV) | 4.5 |

| PAT Margin (%) | 5.26% |

Aeron Composite Limited Contact Details

Saket Ind. Estate, Plot No. 30/31,

Sarkhej Bavla Highway, Village Moraiya,

Changodar, Ahmedabad, PIN Code-382213

Phone: +91-9909988266

Email: [email protected]

FAQs

1. What is the GMP price of the Aeron Composite Limited IPO?

The current GMP price of the Aeron Composite IPO is ₹36.

2. On which exchange will the Aeron Composite IPO be listed?

Aeron Composite Ltd. IPO shares are to be listed on the NSE SME.

3. When is the allotment date for the Aeron Composite IPO?

The allotment date of the Aeron Composite Limited IPO is September 2, 2024.

4. What are the opening and closing dates of the Aeron Composite IPO?

Aeron Composite IPO will open on August 28, 2024 & close on August 30, 2024.

5. When is the listing date for the Aeron Composite Limited IPO?

Aeron Composite IPO’s listing date is September 4, 2024.

Conclusion

Aeron Composite Limited is an Ahmedabad-based manufacturer and exporter of glass fibre reinforced polymer (FRP) products. The financial reports of the company show total debts decreased by ₹1.91 crore (-13.65%) in FY2024 from FY2023, reflecting better debt management by the company. Despite a small revenue drop of ₹1.19 crore (-0.65%) in FY24 from FY23. In FY2024, profit after tax (PAT) increased by 42%. his indicates that the company has become more efficient in generating profit, which enhances its attractiveness for investors. As a result, there is likely to be strong interest in its IPO. so it should be a good choice for investors to invest in this IPO.