Premier Energies Limited IPO Introduction: Premier Energies is India’s largest solar cell and solar module manufacturer. It has an annual installed capacity of up to 2 GW for solar cells and 3.36 GW for solar modules. This company was established in April 1995 and now has five manufacturing units in Hyderabad. The Premier Energies Limited IPO is going to be open to the public on August 27, 2024 and the closing date of the IPO is August 29, 2024. The share allotment date of the Indian Phosphate IPO is August 30, 2024 and the listing date is September 3, 2024.

This is a book-built fresh-issue initial public offering (IPO), with a total issue size of ₹2,830.40 crore for 62,897,777 shares. Whereas the fresh issue is ₹1,291.40 crore for 28,697,777 shares and the offer for sale is ₹1,539.00 crore for 34,200,000 shares. The price band of the Premier Energies IPO is set at between ₹427 to ₹450 per share and the face value is ₹1 per share.

You will find all the information regarding the company and its IPO on this page. This page will be updated regularly with the latest updates regarding the Premier Energies Limited IPO.

Table of Contents

Premier Energies IPO Details

| PO Date | August 27, 2024 to August 29, 2024 |

| Listing Date | Tuesday, September 3, 2024 |

| Face Value | ₹1 per share |

| Price Band | ₹427 to ₹450 per share |

| Lot Size | 33 Shares |

| Total Issue Size | ₹2,830.40 crore for 62,897,777 shares |

| Fresh Issue | ₹1,291.40 crore for 28,697,777 shares |

| Offer for Sale | ₹1,539.00 crore for 34,200,000 shares |

| Employee Discount | Rs 22 per share |

| Issue Type | Book-Built Issue IPO |

| Overall Subscription | 73.96x |

| Listing At | BSE, NSE |

Premier Energies IPO Important Dates

The opening date of Premier Energies IPO is Tuesday, August 27, 2024 and closing date is Thursday, August 29, 2024. Basic allotment date of the IPO is Friday, August 30, 2024 and the listing date is Tuesday, September 3, 2024.

All the important dates regarding the Indian Phosphate Limited IPO are mentioned below. Mark them on your calendar so you don’t miss any events.

| IPO Open Date | Tuesday, August 27, 2024 |

| IPO Close Date | Thursday, August 29, 2024 |

| Basis of Allotment | Friday, August 30, 2024 |

| Initiation of Refunds | Monday, September 2, 2024 |

| Credit of Shares to Demat | Monday, September 2, 2024 |

| Listing Date | Tuesday, September 3, 2024 |

Premier Energies IPO GMP Today

The overall subscription rate of the IPO is 94 times, which show a significant interest of investors to the IPO. Accordingly to the subscription rate the last updated Grey Market Premium (GMP) for the Premier Energies IPO is up to ₹167. The offering price for the Premier Energies Limited IPO is between ₹427 to ₹450 per share.

The following table displays the trend of the Premier Energies Limited IPO’s GMP over the past few days.

| GMP Date | IPO Price | GMP Price |

| September 3, 2024 | ₹427-₹450 | ₹500 |

| September 2, 2024 | ₹427-₹450 | ₹167 |

| September 1, 2024 | ₹427-₹450 | ₹167 |

| August 31, 2024 | ₹427-₹450 | ₹180 |

| August 30, 2024 | ₹427-₹450 | ₹184 |

| August 29, 2024 | ₹427-₹450 | ₹184 |

| August 28, 2024 | ₹427-₹450 | ₹195 |

| August 27, 2024 | ₹427-₹450 | ₹270 |

| August 26, 2024 | ₹427-₹450 | ₹270 |

| August 25, 2024 | ₹427-₹450 | ₹272 |

| August 24, 2024 | ₹427-₹450 | ₹272 |

| August 23, 2024 | ₹427 to ₹450 | ₹275 |

Premier Energies IPO Lot Size

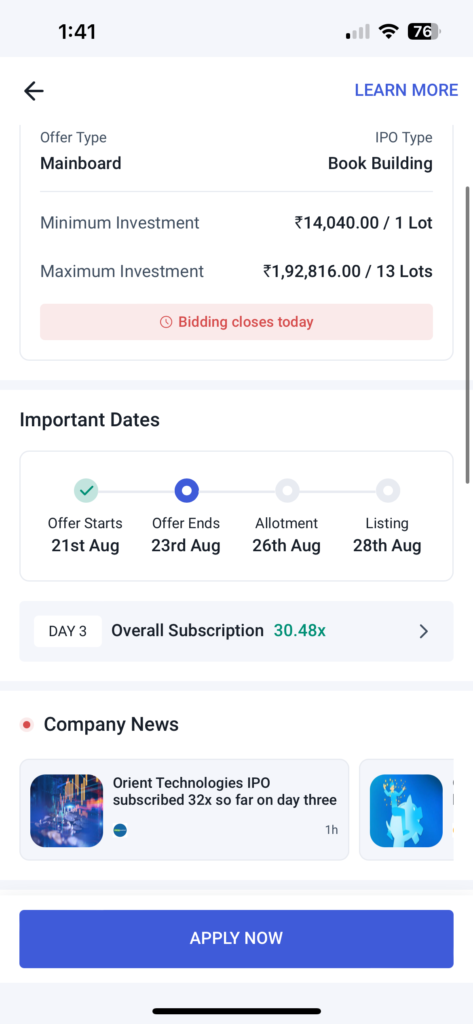

Premier Energies Limited IPO offers a minimum of 33 shares per lot. Retail investors can apply for a minimum of 1 lot and a maximum of 13 lots, while high-net-worth individuals (HNIs) can apply for a minimum of 13 lots and a maximum of 68 lots.

The below table represents the future of minimum and maximum investment for retail investors and HNI concerning shares and amounts.

| Application | Lot Size | Shares | Amount |

| Retail Minimum | 1 | 33 | ₹14,850 |

| Retail Maximum | 13 | 429 | ₹1,93,050 |

| S-HNI Minimum | 14 | 462 | ₹2,07,900 |

| B-HNI Minimum | 68 | 2,244 | ₹10,09,800 |

Premier Energies IPO Shares Offered Quota

| Investor Category | Shares Offered |

|---|---|

| QIB Shares Offered | Not more than 50.00% of the offer |

| Retail Shares Offered | Not less than 35.00% of the Offer |

| NII (HNI) Shares Offered | Not less than 15.00% of the Offer |

How To Apply For Premier Energies Limited IPO?

You can apply for Premier Energies IPO application through Net Banking, IPO Maker Website and using your trading app.

Net Banking: Login to your Internet Banking account, go to the IPO section, and select Premier Energies Limited IPO to apply. Fill in the IPO bid form, enter your CDSL ID and DP account information, and make the payment. You will successfully apply for the IPO. If the IPO is not allotted to you, you will receive a 100% refund.

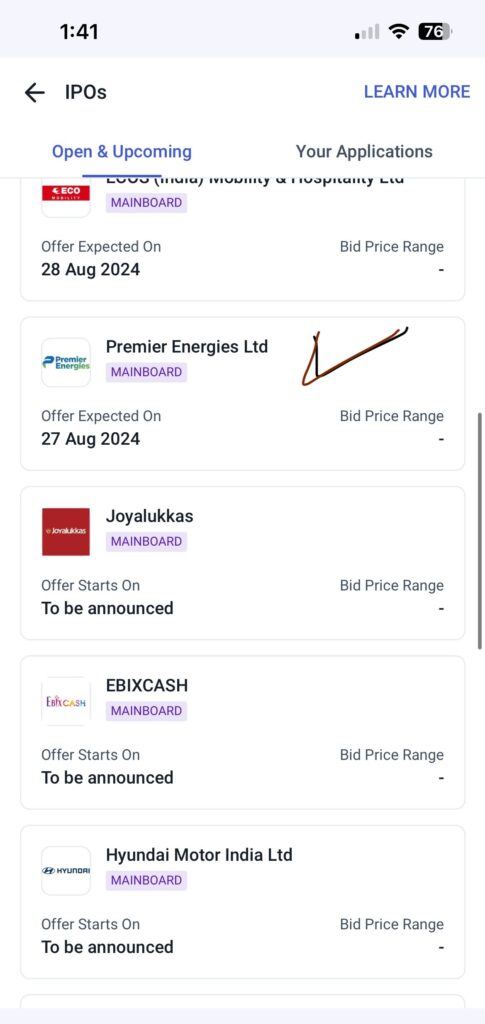

Angel One:

Here’s a step-by-step guide for applying to the Premier Energies IPO using the Angelone app:

- Install the Angel one App:

- Click here to Download the Angel One app from the App Store (for iOS) or Google Play Store (for Android).

- Install and open the app on your device.

- Create an Account: or Log In to Your Account:

- Open the Angelone app.

- Tap on “Sign Up” or “Create Account.” After creating your account, log in using your username and password.

- Navigate to the IPOs section:

- Once logged in, look for the “IPOs” option on the main dashboard or menu.

- Select Premier Energies Limited IPO and then Click on “Apply Now”:

- Choose the lot size you want to apply for.

- Enter your UPI ID where the payment for the IPO will be processed.

- Click on “Apply for IPO”

- Review your application details and click on “Apply for IPO” for the last step confirmation.

By following these steps, you will have successfully applied for the Premier Energies Limited IPO through the Angel One app.

About Premier Energies Limited

Premier Energies Limited is India’s largest solar cell and solar module manufacturer. It has an annual installed capacity of up to 2 GW for solar cells and 3.36 GW for solar modules. This company was established in April 1995 and now has five manufacturing units in Hyderabad. Premier Energies’s top clientele includes NTPC, TATA Power, Panasonic, Continuum, Shakti Pumps, First Energy, Bluepine Energies Private Limited, Luminous, Hartek, Green Infra Wind Energy, Madhav Infra Projects, Solar Square Energy, and Axitec.

In FY2024, Premier Energies Limited financial report show that revenue increase by 116.37% to ₹3,171.31 crore from ₹1,463.21 crore in FY2023. The company also achieved a profit of ₹231.36 crore, reversing the loss of ₹13.34 crore from the previous year. However, their debt rose to ₹1,392.24 crore from ₹763.54 crore. It indicate a strong fundamentals for investment in this IPO.

Premier Energies Limited Financial Reports Of FY2023 and FY2023

- Revenue: Premier Energies Limited promising revenue growth116.37% in FY2024 from FY2023.

- Profit After Tax: In FY2024 the reported PAT is ₹231.36 crore which was -₹13.34 crore in FY2023 which show a improved profitability in this financial year.

- Debts: Total borrowings of the company has grew by 82.55% in the last fiscal year.

| FY | 31 Mar 2024 | 31 Mar 2023 |

| Assets | ₹3,554.13 crore | ₹2,110.69 crore |

| Revenue | ₹3,171.31 crore | ₹1,463.21 crore |

| Profit After Tax | ₹231.36 crore | ₹-13.34 crore |

| Debts | ₹1,392.24 crore | ₹763.54 crore |

FAQs

1. What is the GMP price of Premier Energies Limited IPO?

The current GMP price of the Premier Energies IPO is ₹167.

2. On which exchange will the Premier Energiese LTD IPO be listed?

Premier Energies Ltd IPO shares are to be listed on the NSE and BSE.

3. When is the allotment date for Premier Energies IPO?

The allotment date of the Premier Energies Limited IPO is Friday, August 30, 2024.

4. What are the opening and closing dates of the Premier Energies IPO?

Premier Energies IPO will open on August 27, 2024 & close on August 29, 2024.

5. When is the listing date for the Premier Energies Limited IPO?

Premier Energies IPO’s listing date is September 3, 2024.

Premier Energies IPO Review: Buy Or Not

Premier Energies is India’s largest solar cell and solar module manufacturer. It has an annual installed capacity of up to 2 GW for solar cells and 3.36 GW for solar modules. This company was established in April 1995 and now has five manufacturing units in Hyderabad. In FY2024, Premier Energies Limited financial report show that revenue increase by 116.37% to ₹3,171.31 crore from ₹1,463.21 crore in FY2023. The company also achieved a profit of ₹231.36 crore, reversing the loss of ₹13.34 crore from the previous year. However, their debt rose to ₹1,392.24 crore from ₹763.54 crore. It indicate a strong fundamentals for investment in this IPO. Based on the financial performance our recommendation is strongly buy to this IPO.

Conclusion

Premier Energies shows strongly growth and profitability improvements. Indian government also take many initiative to shifting towards Solar renewable energy sources for reduce greenhouse gas emissions and energy limitation. Invest in Premier Energies IPO will be a profitable for investor. Invest in this IPO at your own risk.

To get more information and regular updates on the Premier Energies Ltd IPO, keep in touch with The Invest Advisory.